YEG Presents as Low Risk Market Amongst Canadian Overvaluation

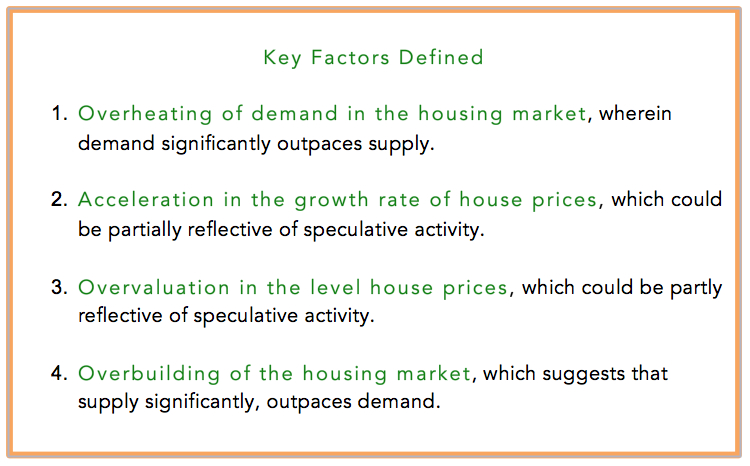

Mon, 18 May The Canada Mortgage and Housing Corporation (CMHC) has recently reported on updated results of their House Price Analysis and Assessment (HPAA) framework. According the CMHC, the analyses attempts to “detect the presence of problematic conditions in Canadian housing markets”. These conditions can range from factors like overbuilding, and overvaluation, to acceleration of home prices, and overheating. The article backgrounder found HERE explains in detail the rubric used in the study.

The Canada Mortgage and Housing Corporation (CMHC) has recently reported on updated results of their House Price Analysis and Assessment (HPAA) framework. According the CMHC, the analyses attempts to “detect the presence of problematic conditions in Canadian housing markets”. These conditions can range from factors like overbuilding, and overvaluation, to acceleration of home prices, and overheating. The article backgrounder found HERE explains in detail the rubric used in the study.

The CMHC article explains further:

“The HPAA is a comprehensive framework that is designed to assess housing market conditions by taking into consideration the economic, financial and demographic drivers of housing markets. The use of multiple indicators of housing conditions, which incorporate various data sources and prices measures, provides a robust picture of overall housing market conditions.”

The study, which was originally published in November of 2014, reviews the market on both a national level overall, as well as focusing on the major influential centres of Vancouver, Calgary, Edmonton, Toronto, Ottawa, Montreal, Québec and Halifax.

The HPAA considers the incidence, intensity and persistence of these four main risk factors that may provide an early indication of the potential for a sharp decline in house prices.

The CMHC concluded in the original report that there was a “modest” overvaluation on a national scale, with that condition persisting in some census metropolitan areas more than others. Edmonton and Calgary were not present amongst the CMA’s listed for overvaluation, showed no indication of overheating, and presented no risk of acceleration.

Late this spring the framework was revisited, as reported by the EREB, to provide an update on the landscape of the Canadian real estate market. Edmonton again fared surprisingly well in the face of a booming market, risk assessments being categorized as “low” overall. Calgary has apparently been showing indicators of overvaluation, however the CMHC goes on to explain that the Alberta’s economic boom and bust cycles are tending to naturally govern problematic factors:

“MLS® sales have declined in recent months in [Edmonton and Calgary], pushing the sales-to-new listings ratio to buyers’ market levels, reflecting the impact of lower oil prices on housing demand in these oil-producing centres. This is expected to place downward pressure on house price growth, which could lessen the current risk of overvaluation in Calgary.”

The EREB also indicated that despite market growth in April, with 1597 sales, the city is showing a slight overall decline in residential sales. REALTORS® association of Edmonton President Geneva Tetreault comments on the current market:

“Sales are definitely down this year, but the sales numbers are still higher than 2011. It is unlikely that anyone would call 2011 a bad year for housing sales. It’s just in comparison to last year, we are not quite as busy. Prices are stabilizing and inventory is robust. We will continue to see increases in sales as we move into the selling season”

The CMHC report would indicate that presently, Edmonton one of the few Canadian CMA’s not presenting market risk factors. CLICK HERE if you are interested in searching for a property or connecting with a Re/Max agent.